Unlocking efficiency, Maximizing Potential

Prime is our gold loan management system that soars past clunky legacy systems.

Delivering instant loan approvals, in-depth reports and intelligent risk insights in a single click. Streamline your operations, empower your staff and watch your business surge towards efficiency and profit.

One Minute Granting

Fast precise appraisals in one minute flat.

-

Automated Valuation Algorithms Utilizes advanced algorithms to appraise gold quickly and accurately, ensuring fast and reliable loan approvals.

-

Instant Document Verification. Integrates with national databases for real-time document verification, reducing manual checks and speeding up the approval process.

-

Smart Workflow Management Streamlines the appraisal and approval process by automating repetitive tasks and guiding staff through necessary steps, ensuring efficiency and consistency.

Risk Assessment

Precise risk modelling minimizing defaults.

-

Predictive Analytics Employs machine learning to predict potential defaults by analyzing historical data and borrower behavior, allowing proactive risk management.

-

Credit Scoring Integration Integrates with credit bureaus to pull up-to-date credit scores and histories, enhancing the precision of risk assessments.

-

Fraud Detection Utilizes pattern recognition and anomaly detection to identify and flag suspicious activities, minimizing the risk of fraudulent loans.

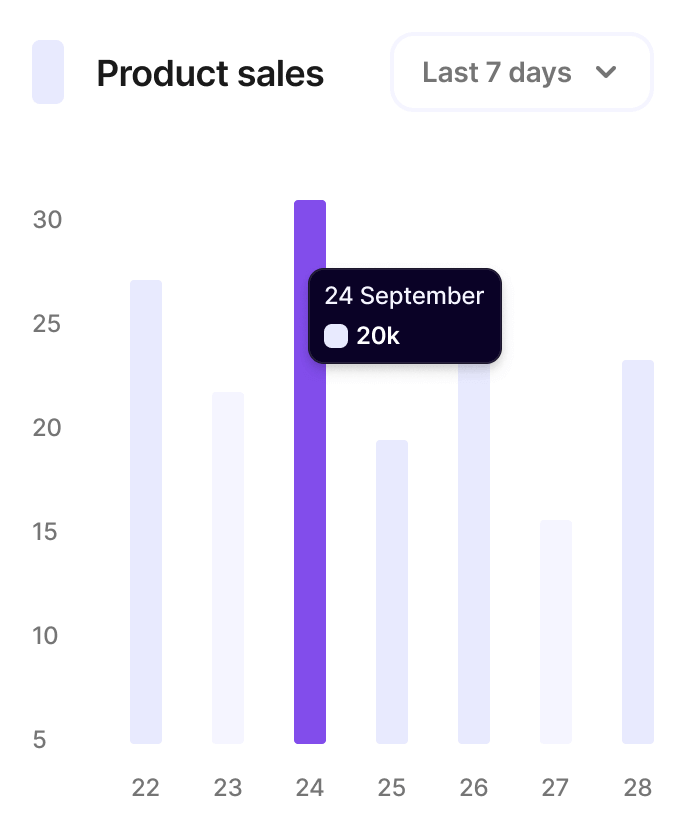

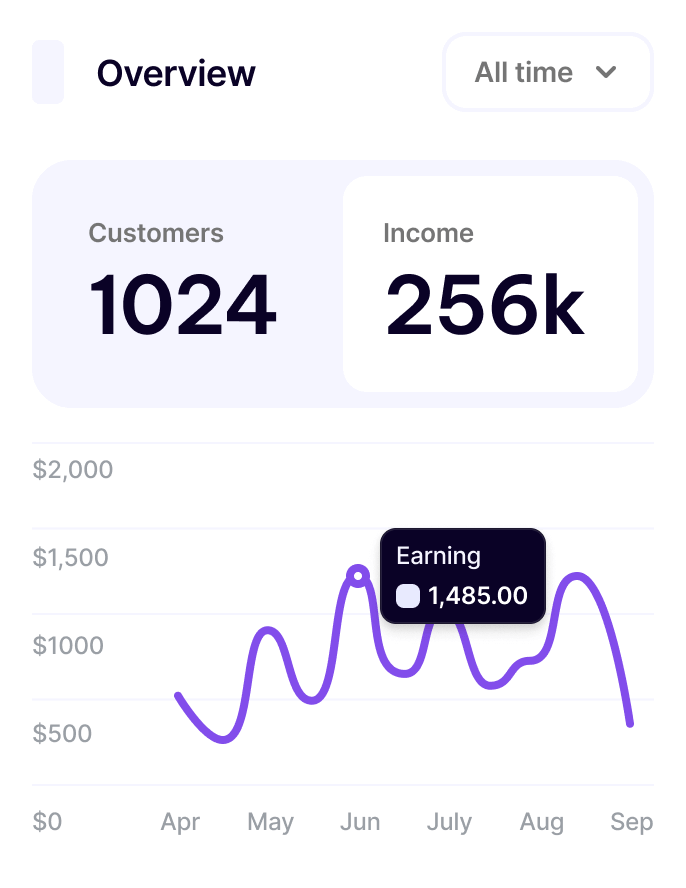

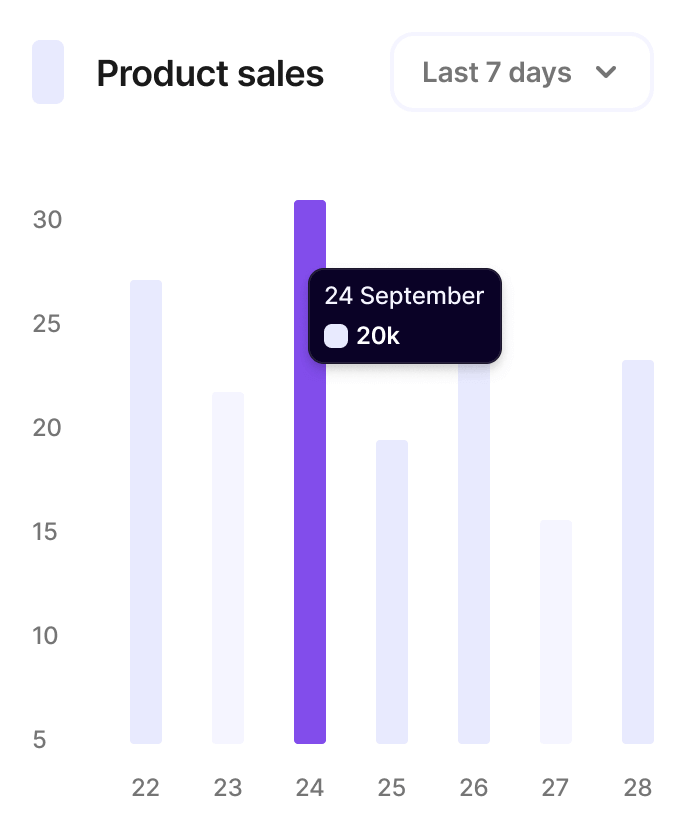

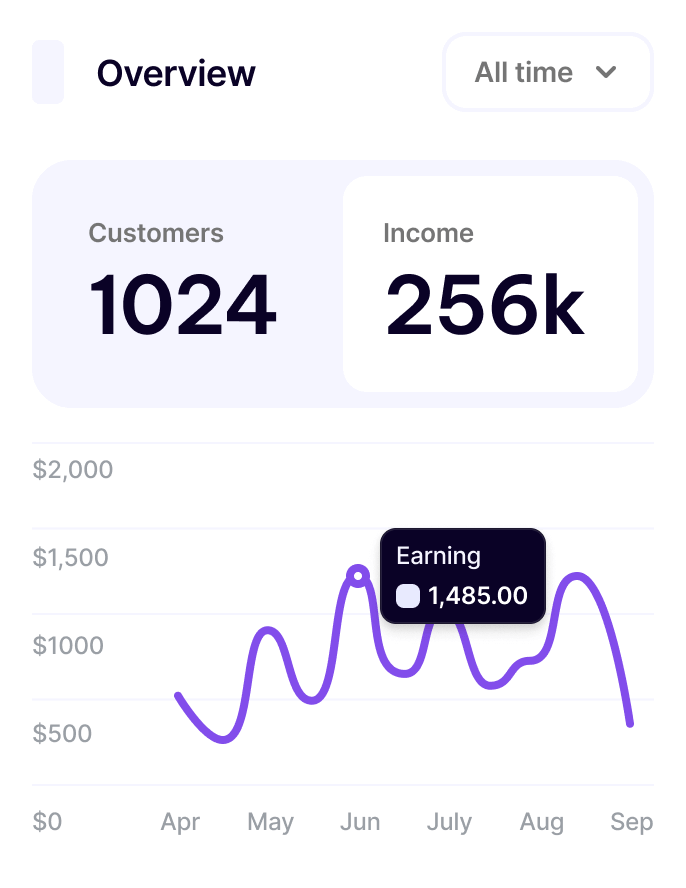

Encompassing Reports

Deep-dive insights, analytics risks & client data.

-

Customizable Dashboards Provides user-friendly dashboards that can be tailored to display key performance indicators and metrics relevant to your business needs.

-

Advanced Analytics Tools Offers tools for detailed analysis, including trend analysis, forecasting, and data visualization, helping to uncover insights from complex data sets.

-

Comprehensive Client Profiles Compiles extensive client data, including transaction history, risk assessments, and personal information, to give a complete picture of each client’s financial status.

Central Bank Complaint

Get the requested reports from CBSL with a click of a button.

-

Automated Report Generation Automatically generates required compliance reports for the Central Bank of Sri Lanka (CBSL) with the click of a button, ensuring timely and accurate submissions.

-

Regulatory Updates Keeps the system updated with the latest regulatory changes and requirements, ensuring ongoing compliance without manual intervention.

-

Audit Trails Maintains detailed logs of all transactions and actions within the system, providing a clear and traceable record for audits and reviews.

Launch with ease

Seize the opportunity – empower your business

Experience the ease of automation, the power of analytics, and the impact of seamless integration. Your journey begins now!